Legislation in Response to COVID-19 Supports Providers and Families

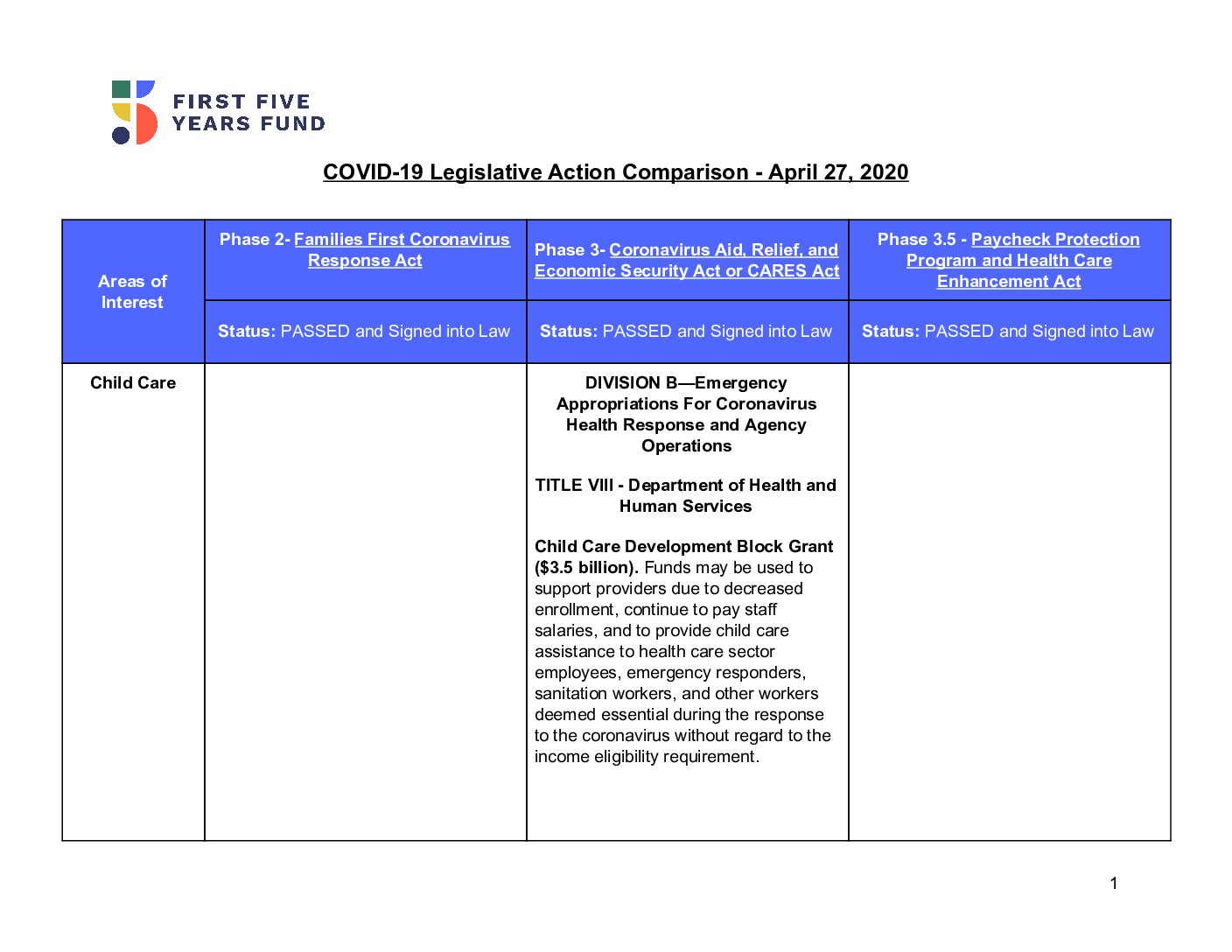

Recognizing the essential role of child care — its proven benefits to a child’s learning and healthy development and its support of America’s labor market and economy by allowing parents to work or attend school — the federal response to the COVID-19 pandemic has included assistance to young children, their families, and the child care providers who care for them. For example, Phase 1, the Coronavirus Preparedness and Response Supplemental Appropriations Act, included $20 million in additional Small Business Administration (SBA) Disaster Loans and provided immediate funding for the domestic and global response to COVID-19. Phase 2, the Families First Coronavirus Response Act, requires employers with fewer than 500 employees to provide paid sick and family leave. In return, employers and self-employed individuals are eligible for a refundable tax credit to offset the costs of such leave. The Act also expanded unemployment benefits and food assistance.

On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provided substantial support to various sectors of the economy, including to small businesses and direct financial assistance to Americans. While the CARES Act included significant support for small businesses, including the new Paycheck Protection Program (PPP), the funds to support small businesses were depleted by April 16th, less than two weeks after PPP launched. Acknowledging the importance of small businesses, on April 23, 2020 Congress again took action and passed Paycheck Protection Program and Health Care Enhancement Act. This legislation changes some rules for the PPP as well as provides additional funding for the PPP, emergency disaster grants, and the health care sector while leaving much of the CARES Act unchanged.

This resource shows provisions of enacted legislation in response to COVID-19 and directly compares related provisions in the Families First Coronavirus Response Act, the CARES Act, and Paycheck Protection Program and Health Care Enhancement Act. To learn more about the supports that CARES includes for small business and how that impacts child care providers check out FFYF’s small business resources.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.