Side-By-Side: Comparing Tax Bills, 2024

The federal tax code contains benefits designed to help working families offset the expense of child care.

Unfortunately, these provisions have not been updated in decades. Today, they have not kept pace with the cost of child care and, as a result, are limited in their ability to help working parents find and afford quality child care.

By pairing tax reform with robust funding to strengthen child care, we can support working families with young children while ensuring greater economic stability across the country.

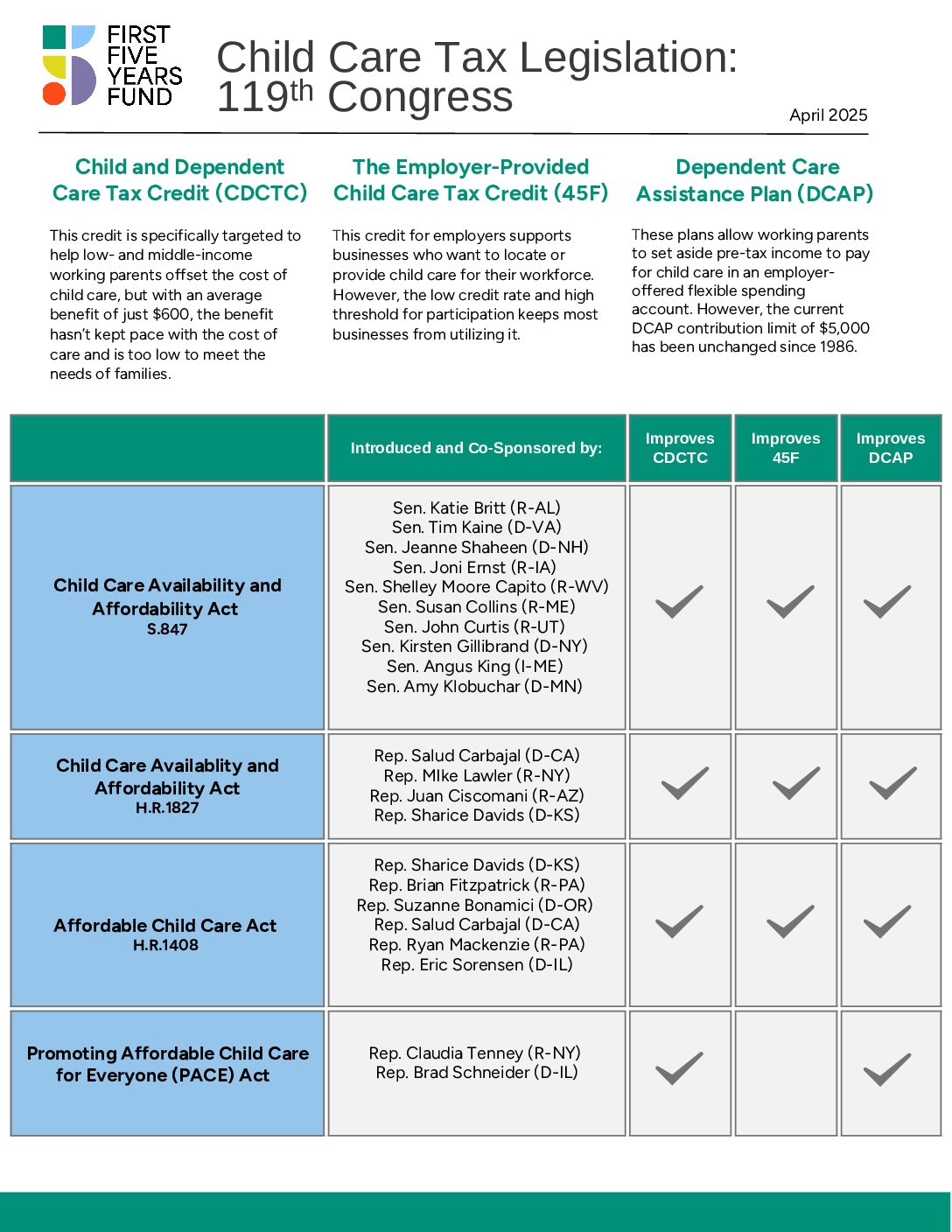

Below is a list of bills in the 118th Congress which would address many of these concerns. They include proposals to update the Child and Dependent Care Tax Credit (CDCTC), the Employer-Provided Child Care Tax Credit (45F), and the Dependent Care Assistance Plan (DCAP).

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.