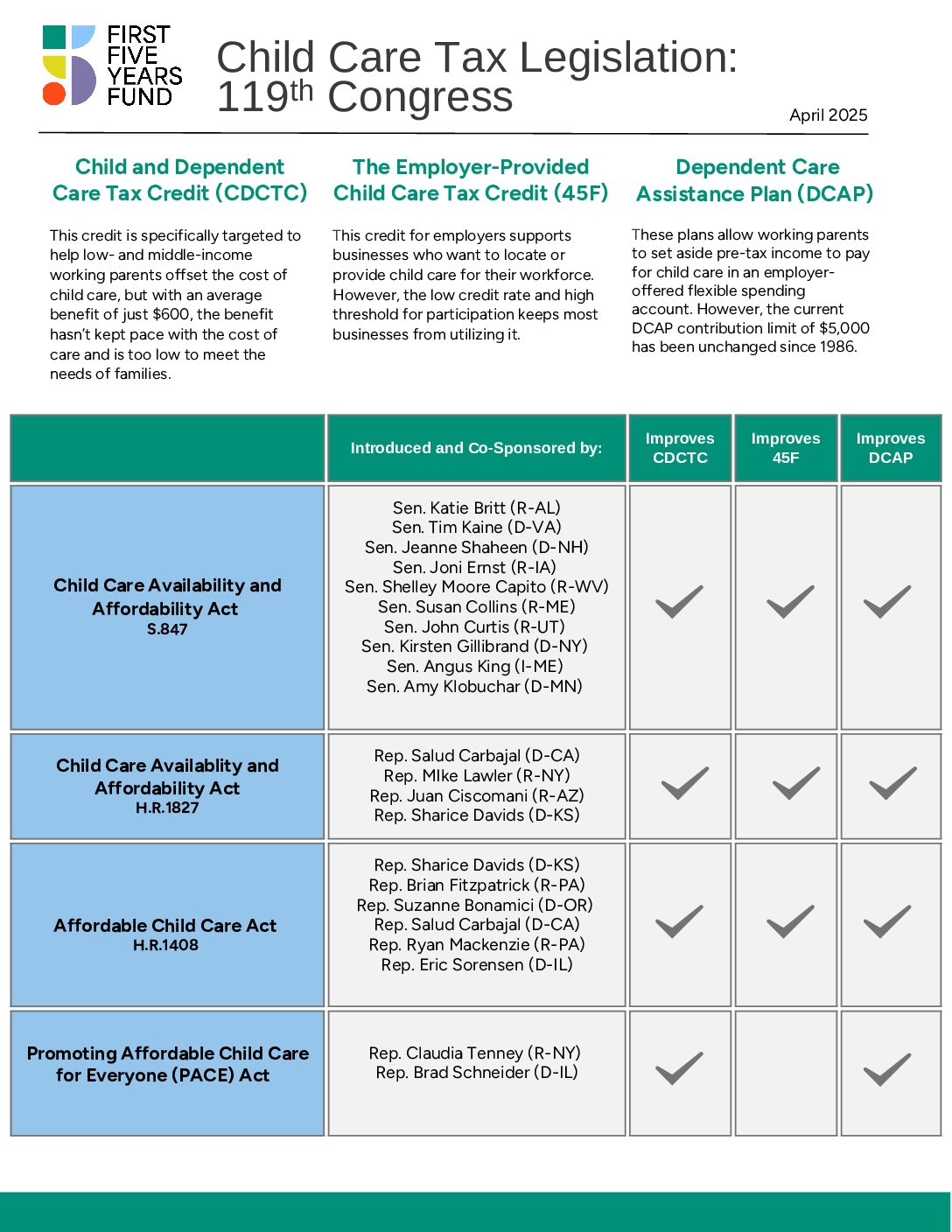

Child Care Tax Legislation: 119ᵗʰ Congress

Child and Dependent Care Tax Credit (CDCTC)

This credit is specifically targeted to help low- and middle-income working parents offset the cost of child care, but with an average benefit of just $600, the benefit hasn’t kept pace with the cost of care and is too low to meet the needs of families.

The Employer-Provided Child Care Tax Credit (45F)

This credit for employers supports businesses who want to locate or provide child care for their workforce. However, the low credit rate and high threshold for participation keeps most businesses from utilizing it.

Dependent Care Assistance Plan (DCAP)

These plans allow working parents to set aside pre-tax income to pay for child care in an employer offered flexible spending account. However, the current DCAP contribution limit of $5,000 has been unchanged since 1986.

Legislation Details

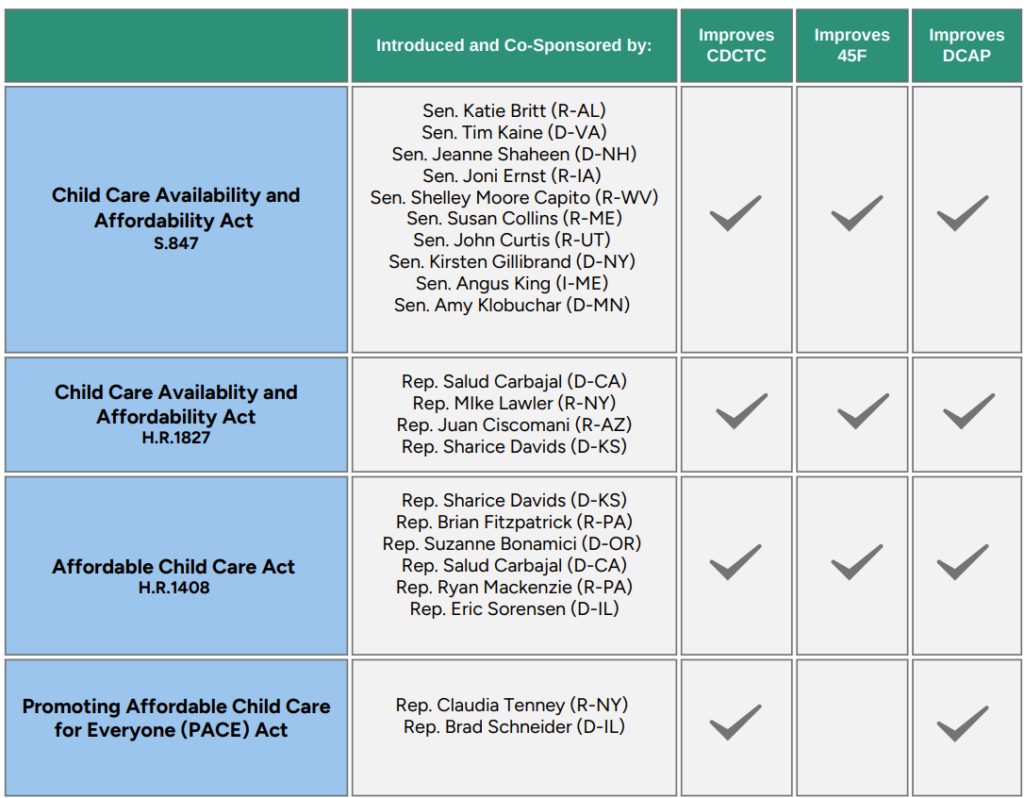

Child Care Availability and Affordability Act

- S.847 – Sen. Katie Britt (R-AL), Sen. Tim Kaine (D-VA), Sen. Jeanne Shaheen (D-NH), Sen. Joni Ernst (R-IA), Sen. Shelley Moore Capito (R-WV), Sen. Susan Collins (R-ME), Sen. John Curtis (R-UT), Sen. Kirsten Gillibrand (D-NY), Sen. Angus King (I-ME), Sen. Margaret Hassan (D-NH), Sen. Amy Klobuchar (D-MN), Sen. David McCormick (R-PA), Sen. Thomas Tillis (R-NC), Sen. Mark Warner (DVA)

- H.R.1827 – Rep. Salud Carbajal (D-CA), Rep. Mike Lawler (R-NY), Rep. Juan Ciscomani (R-AZ), Rep. Sharice Davids (D-KS)

- Reintroduced: February 2025

- This bill modernizes existing tax credits to offset the high cost of child care for working families by making the CDCTC refundable for low- and middle-income families while increasing the maximum amount that parents can receive from $1,050 for one child to $2,500, and from $2,100 for 2 or more children to $4,000. It also increases the max amount that can be saved by a family through DCAP to $7,500, and increases the maximum credit amount of 45F to $500,000 and the max percentage of costs covered from 25% to 50% (and to 60% for small businesses and those in rural areas), allowing for employers to better support their employees in locating and affording child care.

Affordable Child Care Act

- H.R.1408 – Rep. Sharice Davids (D-KS), Rep. Brian Fitzpatrick (R-PA), Rep. Ryan Mackenzie (R-PA), Rep. Suzanne Bonamici (D-OR), Rep. Salud Carbajal (D-CA), Rep. Ryan Mackenzie (R-PA), Rep. Eric Sorensen (D-IL)

- Reintroduced: February 2025

- This bill aims to address several affordability and access concerns by expanding and enhancing existing tax credits to better serve families needs: it doubles the max credit rate for the CDCTC to $6,000 and $12,000; doubles the max credit amount of 45F to $300,000; and doubles the max amount that can be saved by a family through DCAP to $10,000.

Promoting Affordable Childcare for Everyone (PACE) Act

- H.R.2900 – Rep. Claudia Tenney (R-NY), Rep. Brad Schneider (D-IL)

- Reintroduced: April 2025

- This bill helps parents to better afford child care by improving the CDCTC to make it refundable, index it to inflation, and increase the value of the credit, modernizing the credit to better suit the needs of working parents. It also improves DCAP by increasing the amount of pre-tax dollars parents can set aside from $5,000 to $7,500 and indexes the cap to inflation.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.