Child Tax Credit

Posts

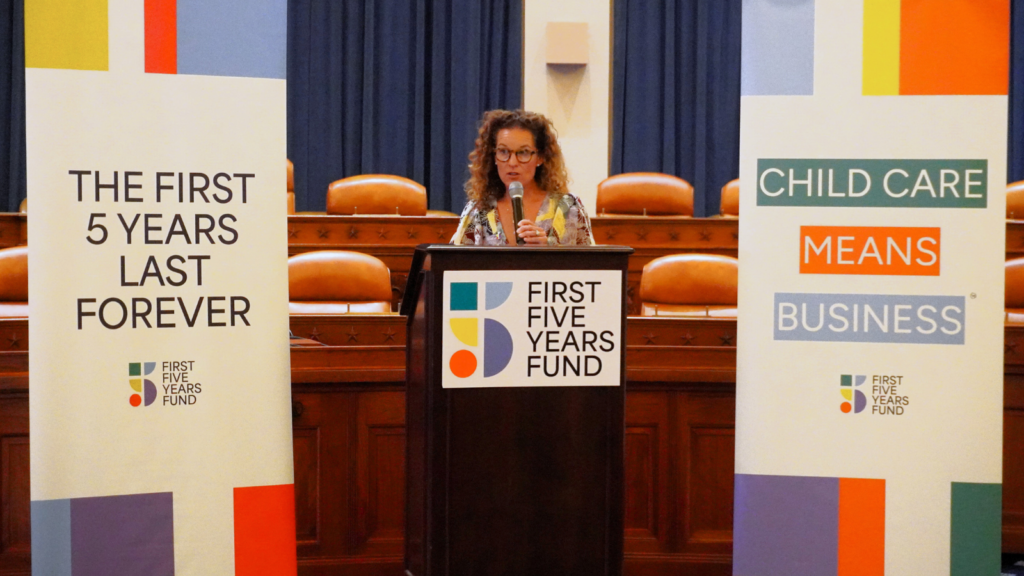

Tax Policy and Child Care

October 1, 2024

Overview Strong funding is essential to strengthening child care in the United States, but updating provisions of the federal tax code is also an important part of the solution. Unfortunately, …

Child Tax Credit

August 18, 2023

Overview The Child Tax Credit (CTC) helps qualifying parents with children under the age of 17 offset the cost of everyday household expenses. CTC is designed to ensure that the …