Tax Code

Posts

The Child Tax Credit and the Child and Dependent Care Tax Credit — Understanding the Difference

The Child and Dependent Care Tax Credit and the Child Tax Credit support families in very different ways. Families need both. Child care is not a luxury for American families …

State by State: Child and Dependent Care Tax Credit

It’s a struggle for millions of hard-working American families to afford quality child care. Federal programs and policies help support working families with child care expenses, but they are limited …

The First Five Questions for: Senators Tim Kaine and Katie Britt

WASHINGTON, D.C. – The First Five Years Fund (FFYF) hosted Senators Tim Kaine (D-VA) and Katie Britt (R-AL) in the latest segment of our First Five Question Series – a …

State Of Play: Federal Child Care Solutions Gain Steam Going Into The August Recess

June and July brought a lot of Congressional momentum, with multiple pieces of proposed legislation that would bring better support to more working families and young children who need quality, …

Senators Kaine and Britt Introduce New Bipartisan Child Care Plan

Washington, D.C. – Today, Senators Tim Kaine (D-VA) and Katie Britt (R-AL) introduced a bipartisan package that will help lower the cost and boost the supply of child care for …

Federal Tax Provisions That Support Child Care

American families depend on affordable, reliable, quality child care to go to work – but this care is often hard to find and too costly. These challenges have a tremendous …

Parents Received $1.5K More Under Temporarily Expanded Child Care Tax Credit

WASHINGTON, D.C. – First Five Years Fund’s new analysis of government data has found that previous expansions of the only tax credit designed to offset child care costs saved …

The First Five Questions For: Caitlin Codella and Liat Krawczyk

In this month’s FFYF’s First Five Questions series – which brings together interesting leaders, experts, and voices together to talk about child care challenges and solutions – Executive Director Sarah …

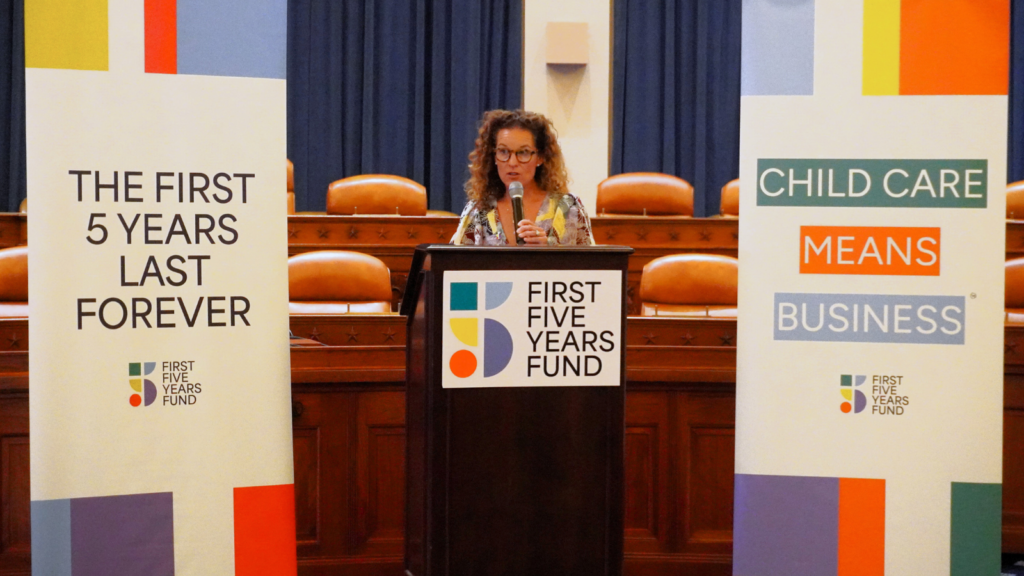

FFYF & Bipartisan Pre-K and Child Care Caucus Host “Child Care Means Business” Event

On June 4th, First Five Years Fund, in conjunction with the Bipartisan Pre-K and Child Care Caucus, hosted lawmakers, bipartisan Congressional staffers, and early learning advocates for a “Child Care …

First Five Questions For Reps. Tenney and Schneider

WASHINGTON, D.C. – The First Five Years Fund (FFYF) hosted Congresswoman Claudia Tenney (R-NY) and Congressman Brad Schneider (D-Il) as part of our First Five Question Series – a monthly …

The First Five Things to Know About: The Child Care Investment Act 2023

Millions of working families with young children need quality child care, but affordable, reliable options can be hard to find. Without it, many parents are forced to miss work or …

New: Bipartisan Bill to Strengthen Child Care Tax Incentives Introduced

The New PACE Act: Today, U.S. House Reps. Claudia Tenney (R-NY) and Brad Schneider (D-IL) introduced the Promoting Affordable Childcare for Everyone (PACE) Act, a bill to enhance existing provisions …