Child Care: Strengthening Tax Incentives to Support Working Families

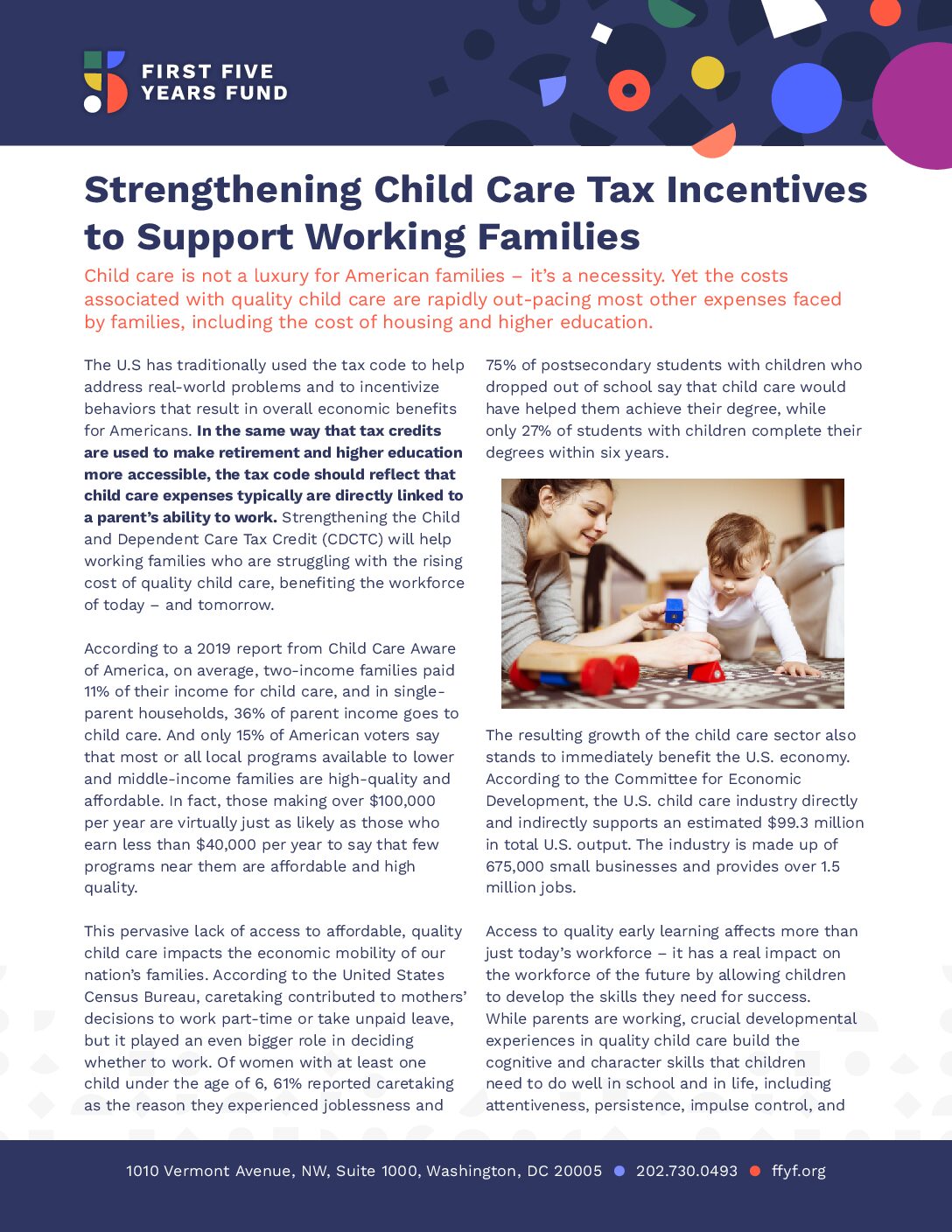

The U.S has traditionally used the tax code to help address real-world problems, and to incentivize behaviors that result in overall economic benefits for American. In the same way tax credits are used to make retirement and higher education more accessible, the tax code should also reflect that child care expenses are often directly linked to a parent’s ability to work. Strengthening the Child and Dependent Care Tax Credit (CDCTC) will help working families who are struggling with the rising cost of quality child care, benefiting the workforce of today – and tomorrow.

While there are currently a handful of tax credits and deductions that support families with children, only the CDCTC was designed to help working parents with the cost of work-related child care expenses. Unfortunately, the CDCTC has not kept pace with the rising cost of child care and remains nonrefundable, making it unavailable to many working families with lower or no tax liability.

Today, the credit varies between 20 and 35 percent of qualified expenses up to $3,000 per eligible child. Qualified expenses are capped at $6,000. That means the maximum credit for working parents with two or more children is $2,100 (35% of $6,000) – only about 10 percent of the average annual cost of care for two children in the United States.

The CDCTC’s expense limits are also not indexed for inflation, so even as child care expenses have risen sharply since 2001, the credit has not changed to meet these increasing costs. What’s more, the credit is not currently refundable. As a result, most low-and some middle-income, tax-paying families are unable to take advantage of it. The Tax Policy Center found that nearly 40 percent of the credit’s value is claimed by families earning $100,000 or more, while almost no families in lower tax brackets were able to access the credit.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.