News & Resources

Posts

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.

The First Five Things to Know About: The Child Care Investment Act 2023

Millions of working families with young children need quality child care, but affordable, reliable options can be hard to find. Without it, many parents are forced to miss work or …

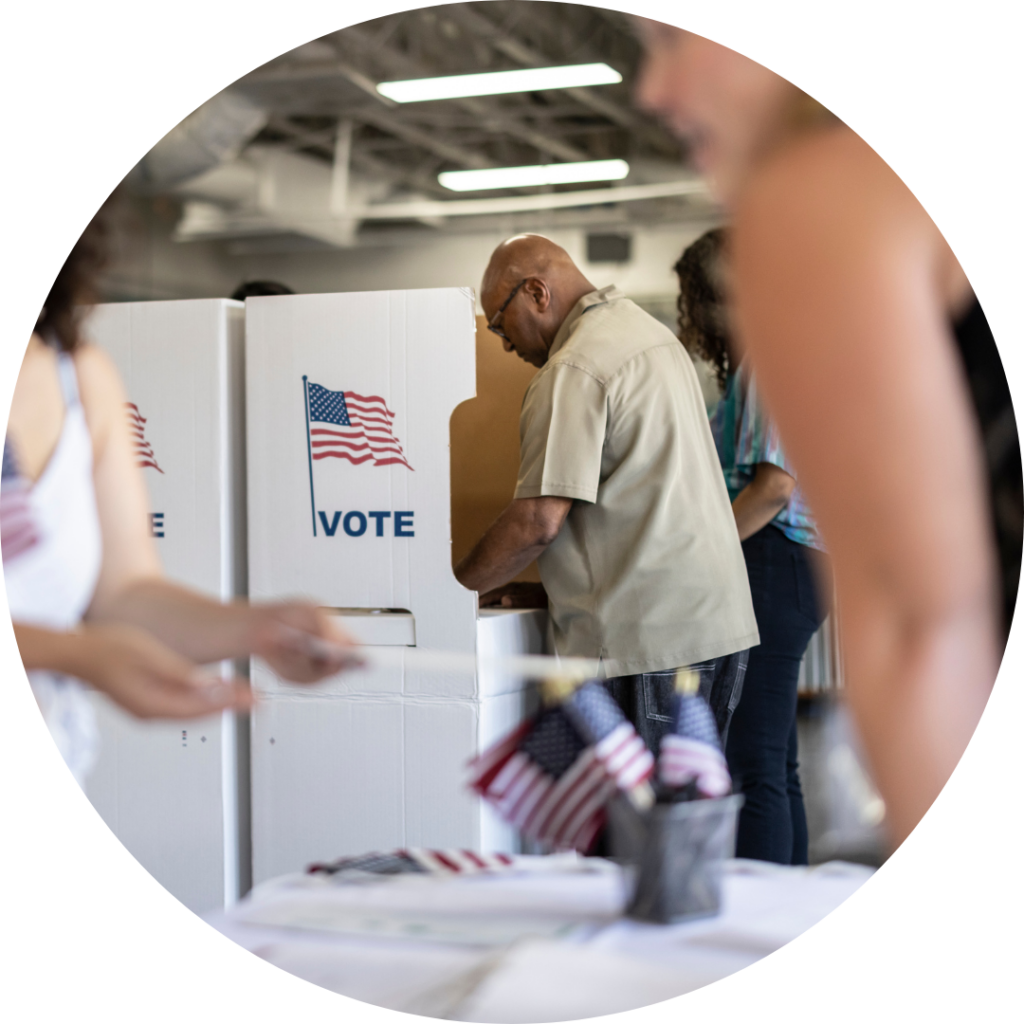

The First Five Things To Know About: A New Poll Showing Voter Support For Child Care Funding

In July 2023, Public Opinion Strategies completed a poll on behalf of the First Five Years Fund, examining voter attitudes toward the issue of child care and early childhood education …

The First Five Things to Know: The Child and Dependent Care Tax Credit

For millions of working parents with small children, child care is a major expense. It is also a necessary expense, as many parents are unable to work without it. The …

On Its Anniversary, Critical Child Care Tax Provision Needs Updating

The Child and Dependent Care Tax Credit (CDCTC) is the only provision of the tax code specifically created to help parents offset work-related child care expenses. The CDCTC was created …

Ahead Of Tax Day, Critical Child Care Tax Provision Needs Updating

Tax Day 2022 is Monday, April 18th, and while much attention has been paid to the vitally important Child Tax Credit (CTC) in recent years, there’s another critical provision of …

Expanded CDCTC Provides Cost Relief to Families This Tax Season

As tax season kicks into high gear, there is one critical tax credit that is the only credit exclusively that helps parents offset the high costs of child care expenses, …

Build Back Better Act: Child Care in the House Ways and Means Committee Package

As part of President Biden’s Build Back Better agenda with proposals to create jobs, cut taxes, and lower costs for working families, the House and Senate are considering the Build …

Child Care and Preschool in the Build Back Better Act

The Biden administration’s proposal to reform and invest in America’s early learning and care system In April, the White House unveiled the details of President Biden’s American Families Plan, …

The Expanded CDCTC Would Help More Families Afford Child Care

On Wednesday, the Bipartisan Policy Center (BPC) released a tool designed to help families understand the expanded CDCTC limits that were temporarily expanded for 2021 under the American Rescue Plan …

Child Care and Early Learning in the Senate Version of the American Rescue Plan

On Saturday morning, the Senate voted to pass the American Rescue Plan, a sweeping pandemic relief package with $39 billion in child care relief funding, including $15 billion for the …

Child Care: Strengthening Tax Incentives to Support Working Families

The U.S has traditionally used the tax code to help address real-world problems, and to incentivize behaviors that result in overall economic benefits for American. In the same way tax …