News & Resources

Posts

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.

Co-Chairs of the Bipartisan Child Care and Pre-K Caucus Call For Updating Tax Provisions to Help Working Families Find and Afford Child Care

Leaders of the Bipartisan Pre-K and Child Care Caucus sent a letter to the Ways and Means Committee, urging their colleagues to update provisions of the United States tax code …

FFYF hosts event with Business Leaders, Reps. Carbajal and Chavez-DeRemer to Talk Tax, Child Care

The First Five Years Fund (FFYF) and Hollis Silverman (founder and owner of Eastern Points Collective) hosted Reps. Salud Carbajal (D-CA) and Lori Chavez-DeRemer (R-OR), child care experts, employers, and …

Rep. Salud Carbajal to Ways And Means: Update Tax Code, Help More Parents Find and Afford Child Care

This week, the House Ways and Means Committee hosted “Member Day,” an annual hearing open to all members of the House of Representatives to come and speak on legislative ideas, …

Bipartisan Bill Seeks to Leverage Existing Tax Credits to Support Working Parents and Employers in Accessing Child Care

Last week, Rep. Salud Carbajal (D-CA) and Rep. Lori Chavez-DeRemer (R-OR) introduced H.R. 4571, the Child Care Investment Act of 2023, which would enhance three existing tax credits to address …

The First Five Things to Know: The Child and Dependent Care Tax Credit

For millions of working parents with small children, child care is a major expense. It is also a necessary expense, as many parents are unable to work without it. The …

On Its Anniversary, Critical Child Care Tax Provision Needs Updating

The Child and Dependent Care Tax Credit (CDCTC) is the only provision of the tax code specifically created to help parents offset work-related child care expenses. The CDCTC was created …

Ahead Of Tax Day, Critical Child Care Tax Provision Needs Updating

Tax Day 2022 is Monday, April 18th, and while much attention has been paid to the vitally important Child Tax Credit (CTC) in recent years, there’s another critical provision of …

Expanded CDCTC Provides Cost Relief to Families This Tax Season

As tax season kicks into high gear, there is one critical tax credit that is the only credit exclusively that helps parents offset the high costs of child care expenses, …

With Release of Budget Resolution, Child Care and Preschool Should Remain a Top Priority in Reconciliation Package

UPDATE: On Wednesday, August 11th, the Senate voted to approve the budget resolution, setting the stage for Congressional Democrats to craft a sweeping economic package with significant investments in child …

The Expanded CDCTC Would Help More Families Afford Child Care

On Wednesday, the Bipartisan Policy Center (BPC) released a tool designed to help families understand the expanded CDCTC limits that were temporarily expanded for 2021 under the American Rescue Plan …

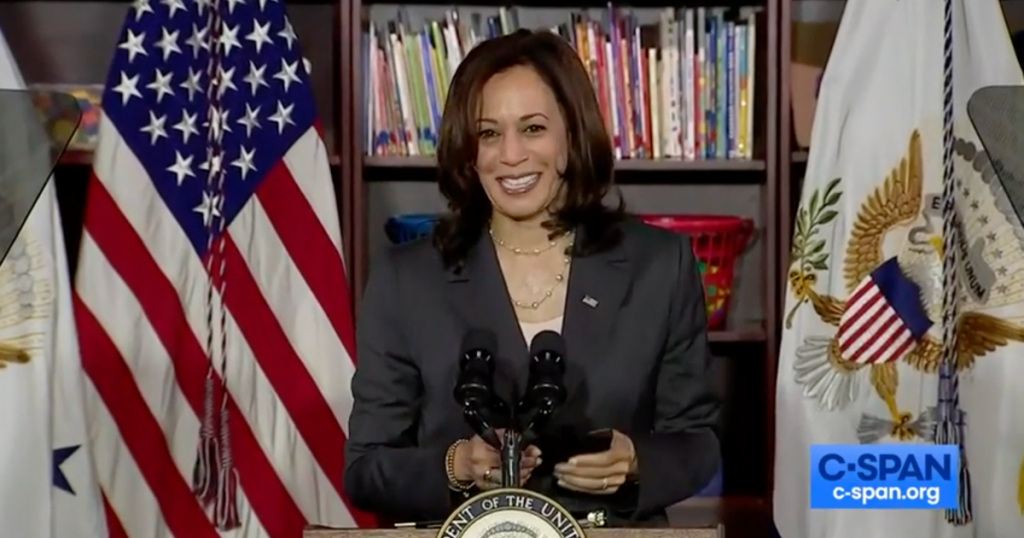

VP Harris Announces ‘Child Tax Credit Awareness Day,’ Highlights American Rescue Plan Successes for Child Care

Earlier today, Vice President Kamala Harris visited CentroNía, a high-quality early learning and care facility in Washington, DC, where she spent time visiting with a group of early learners and …