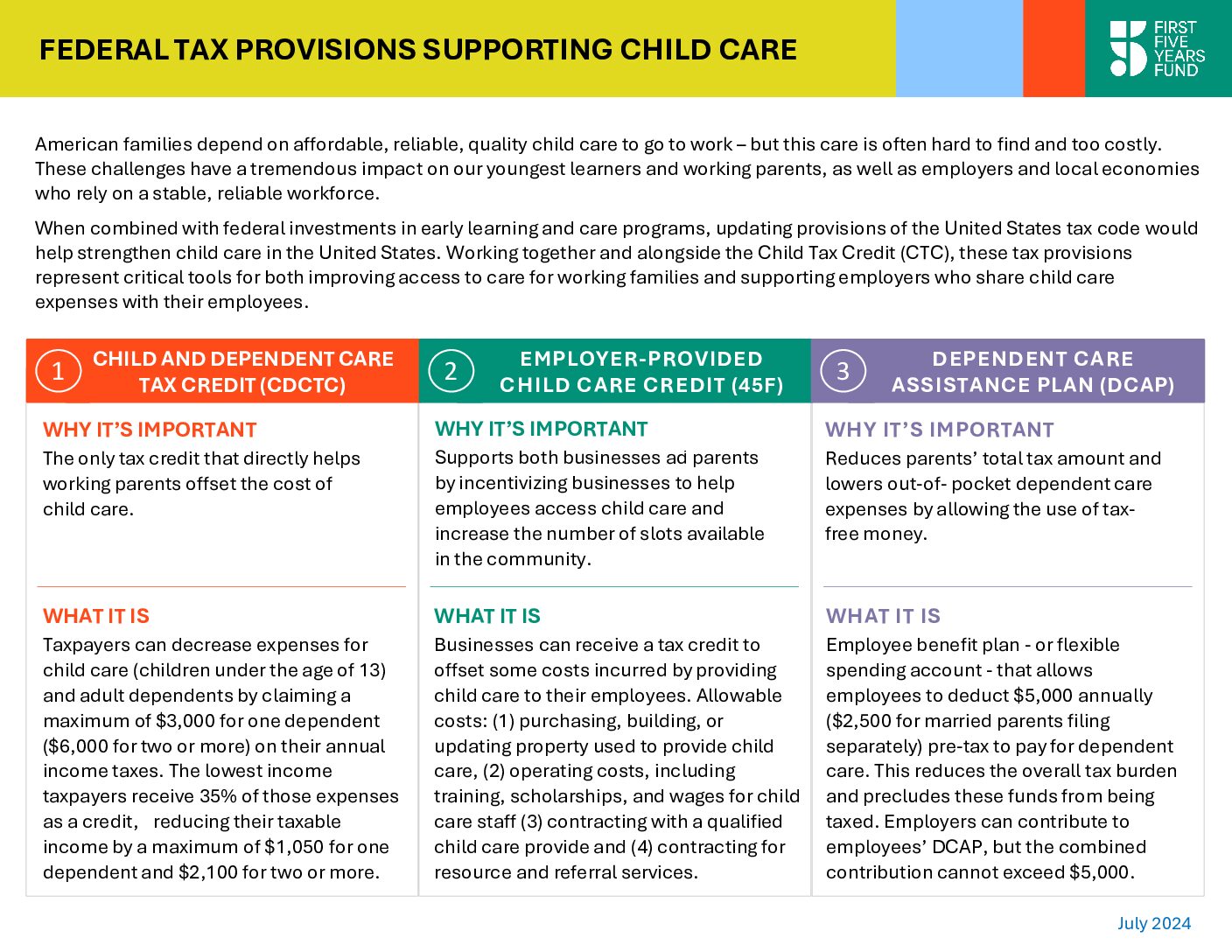

Federal Tax Provisions That Support Child Care

American families depend on affordable, reliable, quality child care to go to work – but this care is often hard to find and too costly. These challenges have a tremendous impact on our youngest learners and working parents, as well as employers and local economies who rely on a stable, reliable workforce.

When combined with federal investments in early learning and care programs, updating provisions of the United States tax code would help strengthen child care. Working together, these tax provisions represent critical tools for improving access to care for working families and supporting employers who share child care expenses with their employees.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.