Child and Dependent Care Tax Credit (CDCTC): Overview

Millions of American families are struggling to find quality, reliable, affordable child care they can depend on. This is having a devastating impact on our youngest learners, working families, and the health of local economies. Making quality child care more accessible allows and encourages parents to enter or return to the labor force. It also has a real impact on the workforce of the future by supporting the development of skills children need to be successful later in life.

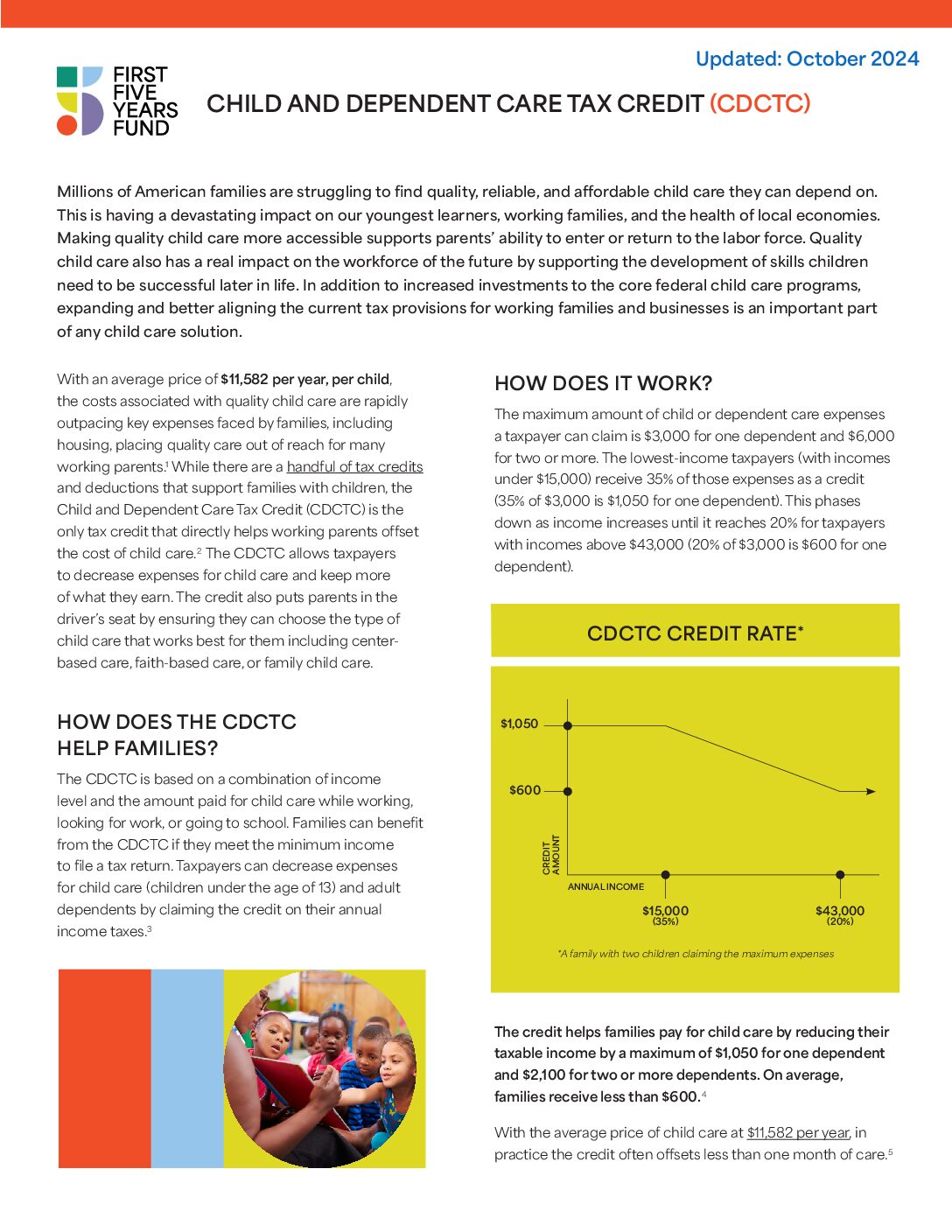

Updating provisions of the federal tax code, including Child and Dependent Care Tax Credit (CDCTC), is an important part of any child care solution as it benefits working parents and young children while supporting economic stability across the country.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.