State by State: Child and Dependent Care Tax Credit

It’s a struggle for millions of hard-working American families to afford quality child care.

Federal programs and policies help support working families with child care expenses, but they are limited in their reach.

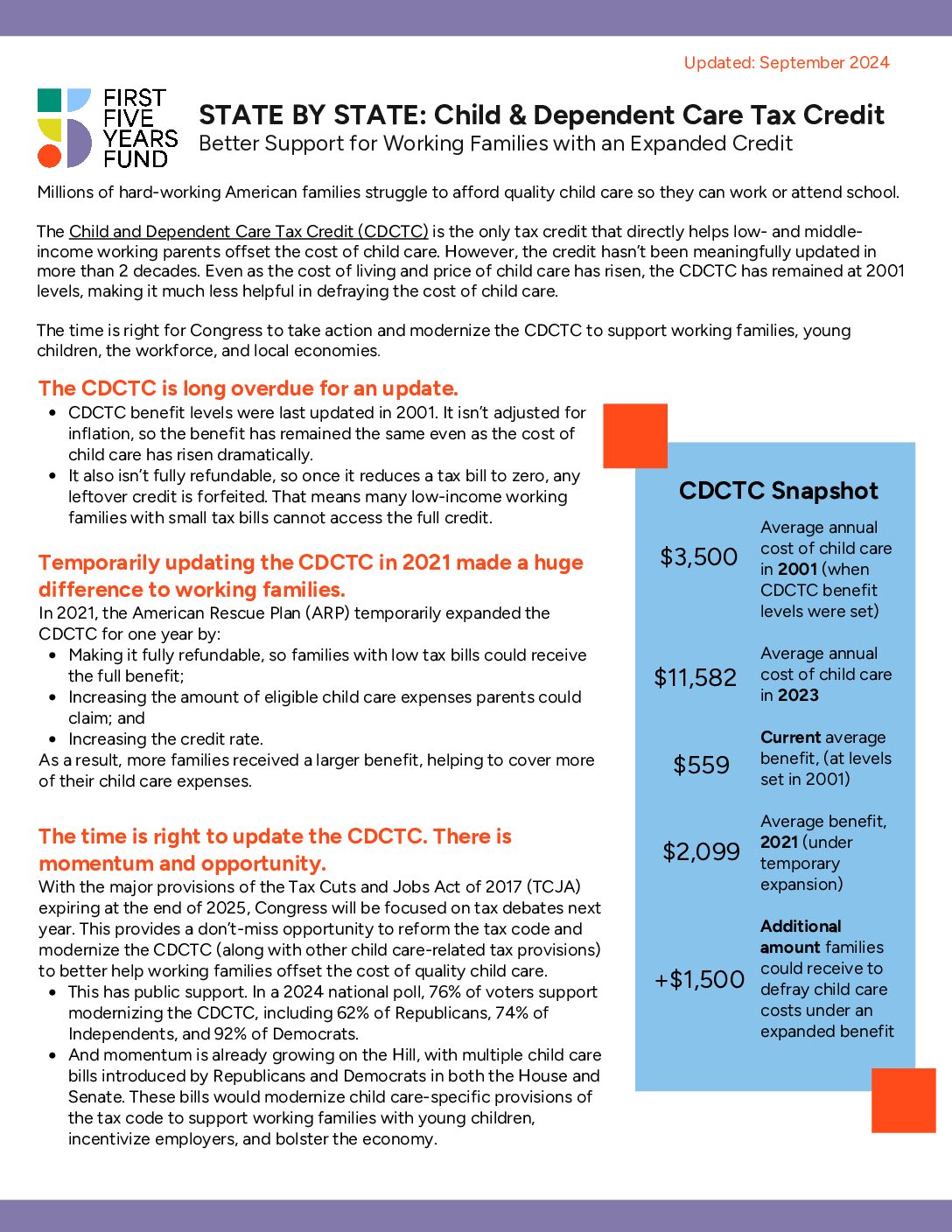

For example, the Child and Dependent Care Tax Credit (CDCTC) is the only tax credit that directly helps low- and middle-income working parents offset the cost of child care. Yet even as the cost of living and price of child care have risen, the CDCTC hasn’t been updated in more than two decades, making it much less helpful in defraying the cost of child care.

It’s long overdue for an update.

The CDCTC was temporarily expanded for a single year in 2021, which made a huge but short-lived difference in the lives of working families, providing them with more meaningful support for child care expenses.

This document shows the impact that expansion had for families across all 50 states. Whether they lived in Nebraska or Alabama, Pennsylvania or Oregon, expanding the CDCTC helped working parents offset the cost of child care and ensured that more young children had access to high-quality early learning opportunities.

Find your state below!

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.