The Child Tax Credit and the Child and Dependent Care Tax Credit — Understanding the Difference

The Child and Dependent Care Tax Credit and the Child Tax Credit support families in very different ways.

Families need both.

Child care is not a luxury for American families – it’s a necessity. Yet the high costs associated with quality child care are rapidly outpacing most other expenses, including the cost of housing and higher education. This is simply untenable for many families.

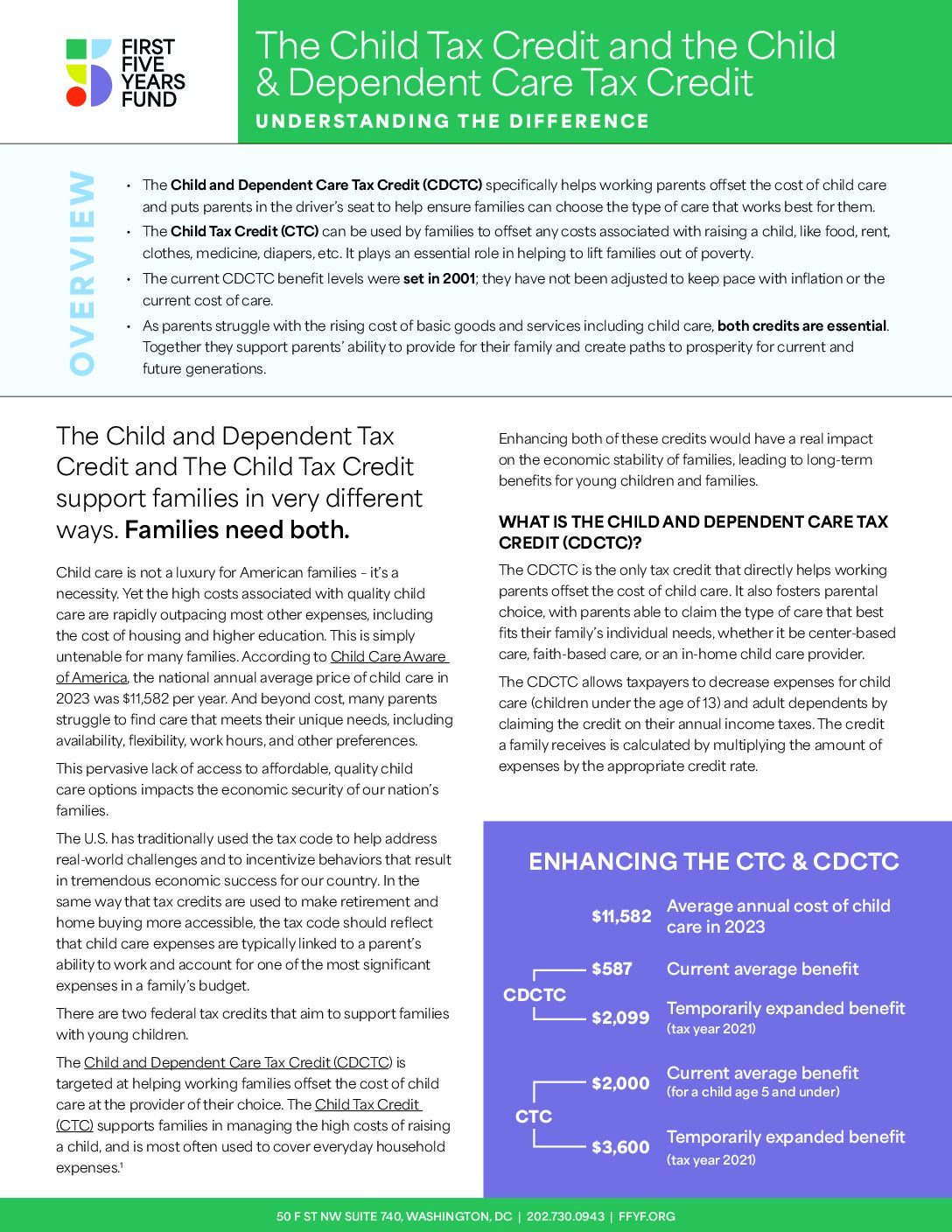

- The Child Tax Credit (CTC) can be used by families to offset any costs associated with raising a child, like food, rent, clothes, medicine, diapers, etc. It plays an essential role in helping to lift families out of poverty.

- The Child and Dependent Care Tax Credit (CDCTC) specifically helps working parents offset the cost of child care and puts parents in the driver’s seat to help ensure families can choose the type of care that works best for them. However, the current CDCTC benefit levels were set in 2001; they have not been adjusted to keep pace with inflation or the current cost of care.

As parents struggle with the rising cost of basic goods and services including child care, both credits are essential. Together they support parents’ ability to provide for their family and create paths to prosperity for current and future generations.

This resource highlights the ways these benefits work, their impact, and why expanding both is essential to better support families with young children.

Subscribe to FFYF First Look

Every morning, FFYF reports on the latest child care & early learning news from across the country. Subscribe and take 5 minutes to know what's happening in early childhood education.